Business Insurance in and around Norfolk

Researching insurance for your business? Search no further than State Farm agent Jim Clark!

No funny business here

State Farm Understands Small Businesses.

Do you own a clock shop, a fabric store or an architect business? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Researching insurance for your business? Search no further than State Farm agent Jim Clark!

No funny business here

Keep Your Business Secure

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, artisan and service contractors or builders risk insurance.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Jim Clark's team to discuss the options specifically available to you!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

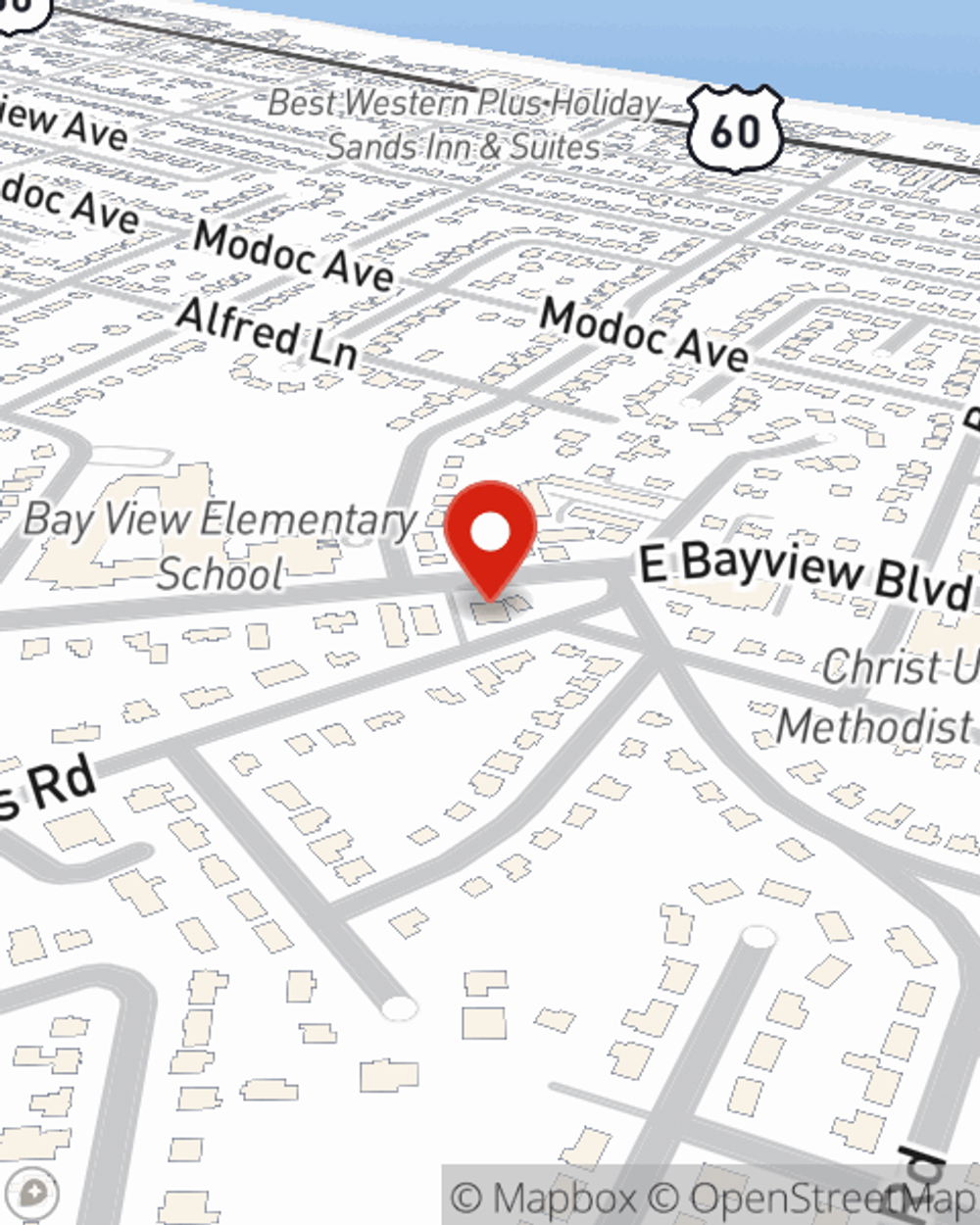

Jim Clark

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.